|

|

Dear Clients,

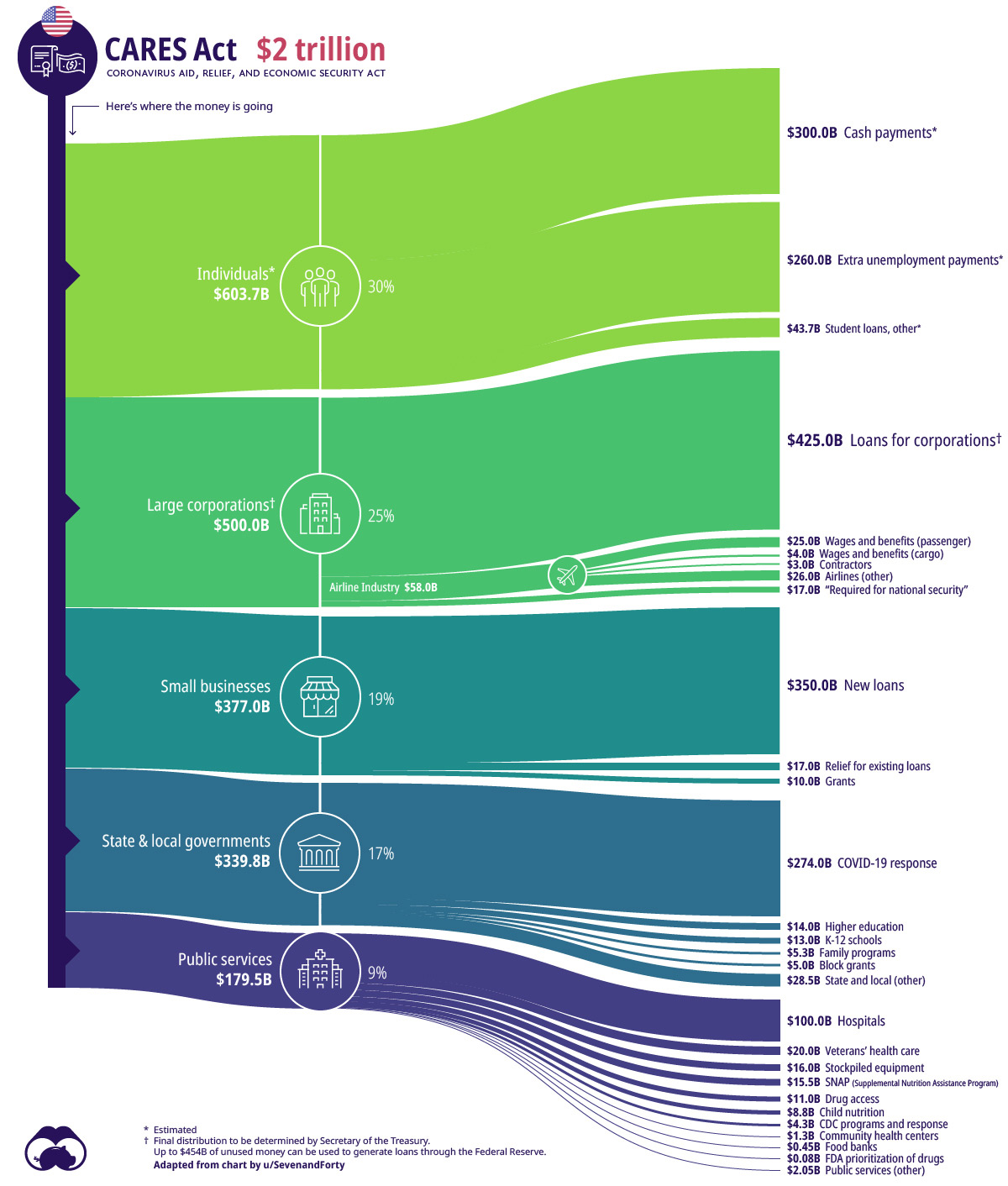

Last month Congress passed the $2 trillion "Coronavirus Aid, Relief, and Economic Security (CARES) Act" which includes stimulus payments to individuals, expanded unemployment coverage, student loan changes, different retirement account rules, and more.

Individuals with a Social Security Number who are not dependents may receive $1,200 (single filers and heads of household), or $2,400 (joint filers), with an additional rebate of $500 per qualifying child, if they have adjusted gross incomes under $75,000 (single), $150,000 (joint), or $112,500 (heads of household) using their 2019 tax return information. (The IRS will use 2018 tax returns if a taxpayer has not yet filed for 2019.) The rebate is reduced by $50 for every $1,000 of income earned above these thresholds.

To ease the strain on businesses, the Small Business Administration (SBA) has also been given $350 billion to provide loans of up to $10 million to qualifying organizations. These funds can be used for mission-critical activities, such as paying rent or keeping employees on the payroll during COVID-19 closures. As well, the bill sets aside $10 billion in grants for small businesses that need help covering short-term operating costs.

There is a lot of information being shared about these and other benefits, but not a lot of clarity surrounding them.

If you have any questions about whether or not you qualify for these benefits or others, or how your tax obligations will be impacted going forward, please email (olga@JSBGroupCPA.com) or call me (312-375-1418).

Sincerely,

Olga Ovnanyan

JSB Group

www.JSBGroupCPA.com

|

|

|  |